I wanted to share an insightful piece of information I received from Kelly, one of our new clients at Helderburg. She emphasized the urgency of acting swiftly due to the impending changes the IRS is making to Section 179. This particular section has been a significant benefit for business owners, allowing substantial savings on company vehicle purchases. Notably, the Helderburg 110, which qualifies due to its weight over 6,000 lbs, falls under this category.

The concern is that with the IRS revising the tax code in 2025, opportunities like Section 179 and Bonus Depreciation, which have been popular topics among many clients recently, might no longer be available.

As I am not a tax advisor, I strongly recommend consulting with your accountant to understand all the nuances and potential advantages.

Call me and we can discuss your custom Helderburg or you can put a Helderburg in service right now for your company. Here’s some options that are in Sharon Springs, NY ready to be delivered and I also have a Black 110 in the works that you can put in service this Spring and you can still choose the interior color.

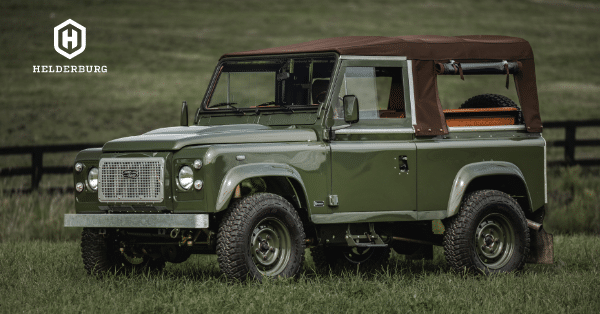

Cicero – See more pictures and get the price.

PS. I’ve also been told that there’s a provision for including vehicles under 6,000 lbs. If that’s the case, Otto the D90 Soft Top, would be an ideal company Defender if you want a great marketing tool.